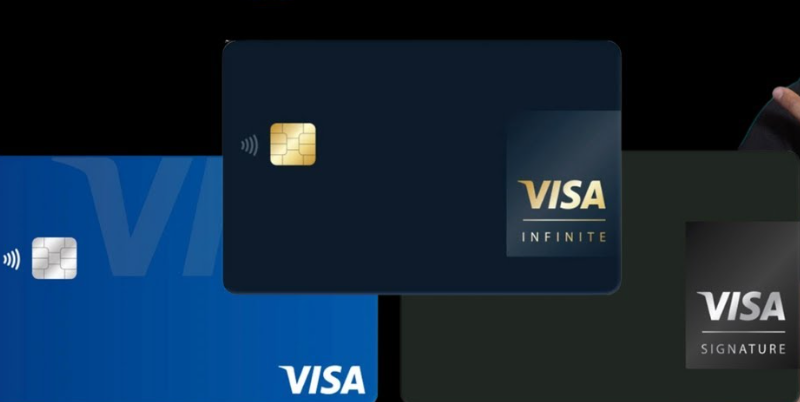

Visa Signature is a brand name on many different credit cards, although the differences between Visa and Visa Signature are not always made explicit.

The benefits of a Visa Signature credit card go above and beyond what other Visa credit cards offer.

The issuing financial institution sets qualifications for obtaining a Visa Signature card and can change from one to the next. Visa states that good or excellent credit may be required in some circumstances before approving a cardholder for a Visa Signature card. Approval Odds compares your credit profile to previously approved applicants or lender criteria.

Advantages unique to Visa Signature cards

Visa credit cards typically provide insurance for car rentals, roadside assistance, emergency access to a replacement card, and cash in the event of loss or theft. These are the typical perks accorded to cardholders, but Visa Signature offers even more.

Replace a damaged card in an emergency.

If your Visa card is lost or stolen, you can get a replacement card within a few days thanks to this perk, which is standard for all Visa cards.

Instantaneous Money

If your Visa Signature cards are lost or stolen, Visa can make arrangements to send emergency cash to a nearby location.

Protection for a rented vehicle

Visa All Signature cardholders are automatically covered for physical damage, theft, and vandalism to their rental cars. You won't be eligible for this perk in most cases unless you forego optional rental car insurance.

Longer-Term Warranty Support

This service will add a year to the original warranty period of any product purchased with your Visa Signature card from a U.S. manufacturer. The warranty duration is doubled if it is for less than one year.

Transportation and help in a pinch

Assistance in a time of crisis can be invaluable. This round-the-clock service can help with anything from finding a lawyer or doctor to translating documents or delivering items like missing luggage or new plane tickets.

Advantages at a few fancy hotels

Luxury hotels worldwide are a part of the Visa Signature Luxury Hotel Collection, which rewards cardholders with perks, including free meals, drinks, and Internet access.

Special pricing on some rental vehicles

For some automobile rental companies, Visa Signature cards might receive discounts. Car rental companies often provide discounts; inquire about them to find out what they offer.

Service similar to that of a butler

Travel logistics, including event ticketing, dinner reservations, and transportation booking, can all be handled with the help of Visa Signature's concierge service. Although you'll still have to pay for these acquisitions, many will appreciate the no-cost assistance.

Various commercial offers

You may be eligible for exclusive savings at select retailers when using a Visa Signature card. Offers can be found on anything from rounds of golf to discounted wine. Approval Odds compares your credit profile to previously approved applicants or lender criteria.

Go to the Playing Card Store Right Now

Potential advantages of using a Visa Signature card

While all Visa Signature cards share common advantages, some may offer supplementary perks. You should contact your card issuer directly to inquire about such benefits.

Insurance for a trip

When traveling, accidents, flight delays, and lost luggage are all things that could significantly impact your experience; some Visa Signature credit cards may provide additional protections.

Safeguarding Prices

If this perk is provided, it can help you get your money back if the listed price of an item you bought with your card is lower than the price you paid.

Coverage upon Return

With this Visa Signature bonus, you can get your money back if a store won't take an item back after a given period.

Credit on Global Entry Statement

If you're flying anywhere, getting Global Entry can save you time at airport security and customs. The $100 application fee may be reimbursed as a statement credit if you have a Visa Signature card.

Do I qualify for a Visa Signature card?

While it's true that some people may benefit more than others from the increased privileges offered by a Visa Signature card, it's also true that not everyone needs or wants one. When applying for a credit card, it's important to only apply for cards that you plan to use.

Think about how you'll use the card, rather than how you might use the card's Visa Signature perks, before applying for a card. Consider whether you want a card with a yearly fee, if you will require the ability to transfer a balance, and if you will be interested in cash-back benefits.