Are you worried about the loan and are interested in Fairway Independence Mortgage to assist you in taking out a loan? If so, our website is the perfect place for you to be. You can decide for yourself using this article's Fairway Independent mortgage evaluation.

A nationwide mortgage lender offers mortgage options, including transformative loans and jumbo, government-backed mortgages and conventionals, and even financing tailored for medical professionals. If you're an elderly homeowner who has paid off most of your mortgage, you can apply for a reverse mortgage at Fairway.

But there's a lot to be disappointed with Fairway's inability to be transparent about rates and lender fees on their website. It also doesn't service all its loans, so your mortgage can be transferred to a different business after closing.

Let’s begin with our Fairway Independent Mortgage review!

Top Perks of Fairway Independent Mortgage

Fast closing times on HECMs for purchase

After you submit your loan application, Fairway can close your HECM for purchase in 17 days. To put things in perspective, most lenders require reverse mortgages to be completed within 30 to 60 days. Therefore, this organization is an excellent option if you want to move into your ideal home.

Loans available for fixer-uppers

If you want enough money for renovations, most lenders only provide a mortgage for buying a property, but in this case, you will need to apply for a second loan for renovations. However, Fairway offers several rehabilitation choices, including FHA 203(k) loans, which give you money for both the purchase of the house and the renovations.

Offers mortgage options specifically for physicians

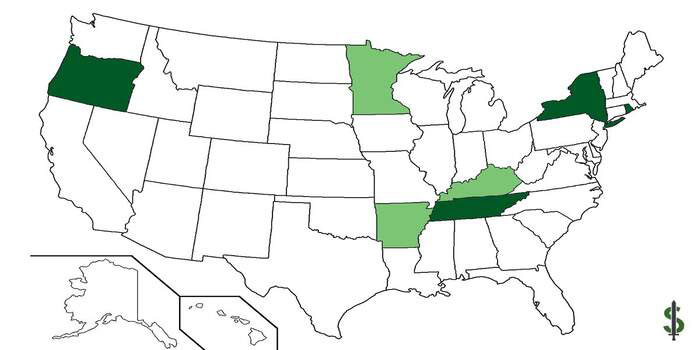

New doctors may need help qualifying for mortgages if they have a lot of loans or need more money for an initial deposit. Fairway's physician loan program helps to solve this issue. In certain states, qualified doctors are spared from mortgage insurance requirements and may finance up to 95% of the cost of a house.

Areas For Improvement In Fairway Mortgage

Not list rates or fees online

It does not offer any rates or fees online. To view rates, one must speak with a Fairway mortgage expert.

Loans that get handled by third-party companies

Fairway does not provide loan servicing for the loans that it originates. Instead, their mortgages are serviced by independent companies, including RoundPoint Mortgage, Chase, and Flagstar Bank. Because customer service standards vary between companies, knowing what to expect when a loan servicer gets chosen can be challenging.

Fairway Mortgage Rates and Fees

Fairway needs to provide details regarding interest rates or costs on its website. Numerous informative publications cover various topics and offer valuable summaries of the present state of the interest market. Still, none of them need to address the rates Fairway offers specifically.

The average mortgage interest rate gives Fairway Mortgage a 2.5 out of 5 rating.

NerdWallet compares mortgage providers' origination costs and available mortgage rates by analysing federal data. We take annual averages from the lenders across all loan categories. In comparison to other lenders, Fairway had somewhat higher rates and fees. Interest rates and additional costs are frequently higher on loans deemed to be riskier.

Some lenders would impose higher upfront costs to reduce their reported interest rate and make it more appealing. Some lenders tack on more significant up-front costs.

Thinking About Applying for a Fairway Mortgage Loan? Here’s How!

If you have decided to apply for a home loan through Fairway Mortgage, you have three options: online, over the phone, or in person at one of their branch offices. (The website allows you to examine the profiles of loan officers in your area.) Alternatively, you can apply using the FairwayNow app, which will enable you to submit documents, follow the status of your application, get in touch with your loan officer, and even look for a place to live.

You'll probably need to produce a range of financial papers to apply for preapproval, such as copies of your pay stubs, current bank statements, and tax returns for at least the last three years, even though Fairway declined to disclose information on its application process, including its average time to closing.

Fairway Customer Service Experience

Based on whether they are regular clients or new customers, there are multiple ways for customers to contact a Fairway representative.

Client Service

Fairway has 24/7 customer service. Customer care can be contacted via phone, email, or in person at a nearby branch. Additionally, you can check your loan status and submit your information via the FairwayNow app.

Customer Satisfaction

Fairway is known for providing excellent customer service overall. In the J.D. Power 2023 U.S. Primary Mortgage Origination Satisfaction Study, the lender was ranked first out of thirty lenders.2. Based on communication, loan closing, application and approval procedures, and loan offers, the study assessed client satisfaction.

Is Fairway Independent Mortgage An Ideal Lender For You?

Absolutely, yes! Fairway's customer service receives high marks, and its selection of home loans is broad enough to accommodate most customers. Looking into this organization is highly advised if your credit score needs to be higher or in the red to be eligible for a mortgage. The company's free credit counselling could be beneficial in that situation.

Having your own house is always a significant financial decision, and choosing a lender can immensely affect the financial state you will ever make. Examine rates and terms offered by a few different lenders and thoroughly consider your options before determining if Fairway Independent Mortgage is the right choice for you.

Conclusion

Even though Fairway Independent Mortgage has a solid reputation for providing excellent customer service, potential borrowers should assess their financial needs and analyze their options before selecting the lender.

Benefits, including faster closing times, financing for fixer-upper buildings, and speciality physician programs, are listed in the Fairway Independent Mortgage. On the other hand, it highlights drawbacks such as the dependence on outside loan servicing and the lack of clarity regarding rates and fees.