Correct retirement preparation requires diligence and patience. If you start planning for retirement early, you have more time to save wealth for your golden years. The retirement calculator on Forbes Advisor can help you assess your current preparedness for retirement. Calculating how much you need to save for retirement is a challenging aspect of retirement planning. The three most prevalent choices are employer-provided retirement plans, investments, and Social Security. Various resources provide lists of recommended objectives. Somewhere between 70% and 85% of your pre-retirement salary is the goal many financial gurus recommend. If your annual income is $100,000, you should save enough to get by on $70,000 to $85,000. In the United States, retirees have a median life expectancy of 20 years1.

Calculate Your Retirement

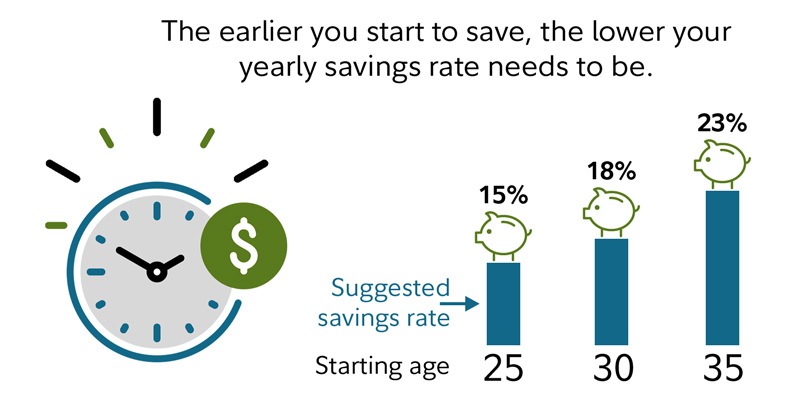

It's simple and complex for working people to picture themselves enjoying their retirement years. While many dreams of traveling the world or retiring to a tropical island, few take the practical steps to make such goals a reality. After all, there are more pressing issues, such as a job, children, a house, a vehicle payment, etc. In the midst of it all, it's tempting to put off saving for retirement, especially if that time is still 15, 20, or 30 years away. Indeed, surveys have proven time and time again that the typical American's retirement savings are too low and that a sizable portion of Americans in their 30s, 40s and even 50s have no retirement savings at all.

3 Steps To Figure Out How Much You Need To Save For Retirement

The first stage in retirement preparation is calculating the sum of money you will need to maintain your current standard of living and pursue your post-retirement goals. How long you plan to enjoy retirement is a significant factor in determining this sum. Here are some simple ways to begin preparing for retirement:

The First Step Is To Determine The Costs

This year's spending will serve as a guidepost for your future needs. The formula you need to do this is "Expenses = Income - Savings." If you earn 10 lakh per year and set aside 3 lakh per year, your annual expenses will be 7 lakh. To get there, you need to do some backtracking and itemize all the costs, which would sum up to 7 lakhs. Remove the costs that will no longer be incurred once you reach retirement age. This means you can keep paying for groceries, utilities, housekeeping, healthcare, annual vacations, insurance premiums, etc. Still, you can stop making monthly loan payments (EMIs) if you plan to pay off your debts before retiring. For the sake of argument, let's say the required sum is 3.5 lakhs.

The Second Step Is To Take Inflation Into Account

It's essential to plan, as the amount of money needed for day-to-day spending today and after retirement differs. Inflation is to blame for this situation. It's the most crucial variable in determining how much money you'll have in retirement. Therefore, if you are 35 years old and spend 3.5 lakhs a year today, you will need close to 12 lakhs a year (@5% inflation) in 25 years (retiring at 60).

Determine Your Expected Length Of Life

There is no way to predict how long they will survive. Due to medical advancements, a longer life expectancy is expected to be the norm in India. According to data from the Union Ministry of Health and Family Welfare, life expectancy in India increased by five years during 2001–2005, when it was 62.3 years for males and 63.9 years for females. These figures stand at 67.3 and 69.6 years, respectively. Those in urban areas of India can expect to live well above 80 years of age since they have ready access to information technology, the internet, and cutting-edge medical treatment. Therefore, by the time you reach age 80, the Rs. 12 lakhs you will need to retire will have risen to Rs. 32 lakhs a year (@5% inflation). It would help if you were as fiscally savvy as possible to keep up with inflation, including your savings, investments, and tax filings. It would help if you looked for a way to invest your money where it has a chance of growing faster than inflation.

Conclusion

If you want to make the most of your money, you need guidance specific to your position. A retirement savings calculator is an excellent place to begin when thinking about your financial security in the future—pursuing your objectives and organizing your finances with the aid of a private wealth management team. Fort Pitt Capital Group prioritizes our client's interests above anything else as a fiduciary but instead as an SEC-registered financial advisor. Every recommendation will consider your unique risk preferences, long-term objectives, and current financial situation.